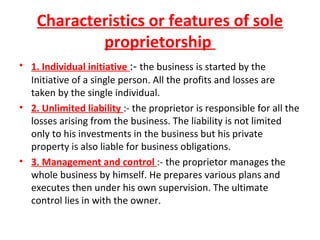

Characteristics of Sole Proprietorship

In a sole proprietorship a single individual engages in a business activity without necessity of formal organization. Like Sole proprietorships owners manage all business parts to grow and earn handsome profits.

Learn About Characteristics Of Proprietorship Chegg Com

Partnership and Sole Proprietorship.

. A sole proprietorship is the most common type of business structure. Characteristics of a Sole Proprietorship. There are quite a few advantages of sole proprietorship such as.

The owner has sole control and responsibility of the business. To help the average person understand when they have a valid contract we have set forth the elements of a contract below. Its easier to set up than any of the other business entities.

Though the process varies depending on the jurisdiction establishing a sole proprietorship is generally an easy and inexpensive process unlike forming a partnership or a corporation. Have fewer than 100 shareholders. Even if the owner hires employees he still personally has full legal responsibility which is one characteristic of a sole proprietorship that sets it apart from other business types.

The two terms do have a close business relationship. As long as the profits do not exceed a certain amount there is a tax advantage because the income is taxed at the personal income level. If the business structure is a sole proprietorship or general partnership you may need the following documentation to complete a.

A partnership is different from a sole proprietorship but also the same to some extent. Ownership of an S Corporation. The most common and the simplest form of business is the sole proprietorship.

The main characteristics of a company are as follows. Assumed Name filings should be used when. You can also elect to file your taxes as a C-Corporation.

Sole proprietorship and partnership forms of business organisations could not meet the growing demands of a very big business because of their limitations such as limited capital limited managerial ability unlimited liability and other drawbacks. Use this form to file an Assumed Name. The easiest and cheapest way to start a business.

He may employ other person for assistance but ultimate authority and responsibility lies with him. The owner maintains 100 control and ownership of the business. Below are some of the characteristics of S corporations.

Its characteristics are similar to that of a corporation and a partnership business. Many people enter into contracts on a daily basis without realizing that they are in a legally binding agreement. Hence you must file your LLC taxes either as a sole proprietorship if its a single-member LLC or as a partnership if its a multi-member LLC.

In this article we are going to study about the characteristics that a good software design must-haveWe will first mention these characteristics and then will define each of them in brief. He prepares the blue prints of the venture and arranges various factors of production. An LLC offers a more formal business structure than a sole proprietorship or partnership.

LLC combines many favorable characteristics of corporations and partnerships. All the profits and losses are. While sole proprietorship does have a difference from a partnership.

With expanded growth and financial. Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Profit is a financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses costs and taxes needed to sustain the activity.

Advantages of Sole Proprietorships 1. The most common forms of business are the sole proprietorship partnership corporation and S corporation. Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations.

To form an S Corp the owners must meet some legal requirements. Legal and tax considerations enter into selecting a business structure. A Limited Liability Company LLC is a business structure allowed by state statute.

Have only one class of stock. How to file a Business License Application for a Sole Proprietorship 1701. Financial institutions sales corporations and insurance companies cannot form an S Corp.

The business is owned by only one person who maintains all liability Partnership. Many parents head into their divorce proceedings without a solid understanding of the differences between full custody and sole custody. A corporation is a legal person with the characteristics of limited liability centralization of management perpetual.

A business with a single owner with no formal or separate form of business structure is known as a sole proprietorship. Since all of the tasks and handling of business are done by a single person. In a small business enterprise capital is supplied by an individual or a small group of individuals.

In partnership one agrees to contribute in terms of money ideas and share the profit in a business. Be an eligible corporation. Any profit that is.

Get the right guidance with an attorney by your side. Unlike a sole proprietorship or partnership an S Corp separates the assets of owners and the company. When an individual creates a sole proprietorship he owns and controls all aspects of the business.

Some of the salient characteristics of small business enterprises are stated below. The LLC provides limited liability to its members. For good quality software to be produced the software design must also be of good quality.

The sole proprietorship has unlimited liability all profits and losses belong to the owner. They arent Apr 28 2022 3 min read. As defined by the IRS a sole proprietor is someone who owns an unincorporated business by himself or herself The key advantage in a sole proprietorship lies in its simplicity.

Characteristics of Sole Proprietorship. Compared to other business forms there is very little paperwork a proprietor. The business is owned by two or more people who have limited liability and split the profits.

A person conducting business under a business name which does not contain their true full personal name. As per a census of small scale units in India mostly small business enterprises are run as sole- proprietorship and partnership. Adding different talent in the business personal relations experiences and capital is a few of the most important benefits of the partnership.

Its dissolution too is governed by the states law. Our network attorneys have an average customer rating of 48 out of 5 stars. Submitted by Monika Sharma on October 11 2019.

This business is started by the initiative of a single person. Sole Proprietorship or General Partnership Before you begin. However a major challenge might be in success itself.

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

Characteristics Of Sole Proprietorship By Archanamamidala Medium

Meaning And Characteristics Of A Sole Proprietorship Archives Faceless Compliance

0 Response to "Characteristics of Sole Proprietorship"

Post a Comment